Merry Christmas everyone.

As we approach a new year, I thought it might be worthwhile to post some thoughts that have been churning around in my head regarding the state of our nation. I'm afraid this post is going to pose a number of questions and not a lot of answers. But nonetheless I wanted to at least put these thoughts out here to see what others think.

I've been thinking of this post for a while, but was prompted to actually do it today after listening to the

NY Times Front Page podcast, and hearing that "

retail spending rose 5.5 percent in the 50 days before Christmas." This seemed to fit with what I saw in the past couple months - malls and retail outlets were packed with shoppers. But the story doesn't add up to me. Isn't the unemployment rate still

almost 10 percent? How is it that people can afford to spend as much as they did in the same period of 2005?

The Times article quotes Craig R. Johnson, president of the consulting firm Customer Growth Partners saying "In the face of 10 percent unemployment and persistent housing woes, the American consumer has single-handedly picked himself off the mat, brushed his troubles off and strapped the U.S. economy on his back." Let's see, unemployment still high, housing prices still low... maybe if we spend more that will fix it? The economy is slow, let's extend a lot of credit to

people who don't really understand (or don't want to understand) the risk of credit card debt? It worked in 2005, maybe it will work again? Am I the only one who finds it strange that this man is applauding the American Consumer for what I can only see as the same pattern of reckless lifestyle that helped get us into this mess?

So that got me to wondering exactly how much money Americans are saving. A couple months ago I listened to the episode "

Is America Ready for a 'No-Lose Lottery'?" on Freakonomics Radio. The episode presents an idea worthy of its own discussion - can a lottery be used to encourage people to save? But the story used to setup the episode was what stuck with me.

In a survey last year, 2100 Americans were asked if they could come up with $2,000 cash in thirty days. 46% of Americans said they could not. The survey consisted of people from all income brackets, and the result I found most alarming was that of people making between $100,000 and $150,000 a year, 25% responded that they could not come up with $2,000 in thirty days. Now, the sample size is a bit small. So I won't dwell on this too long. But still.

OK, so back to how much Americans are saving. According to the Bureau of Economic Analysts, as of November 2010,

Americans are saving about 5.3% of their disposable income. If you look back through the years in that link, you'll see that this is about as good as it has been for the past decade, about the same as the 90's, worse than the 80's, much worse than the 70's and worse than the 60's.

So Americans are saving a smaller portion of their disposable income than they saved in the past.

Is that a bad thing? Taken at face value, one would say yes. But there are other factors to consider. Perhaps Americans don't need to save as much because they're getting more for their dollar. Compared to the rise in inflation,

healthcare and

education costs are increasing much more rapidly. So, I'd say no, we're not getting more for our money, and yes, the decrease in percentage of disposable income saved is a bad thing.

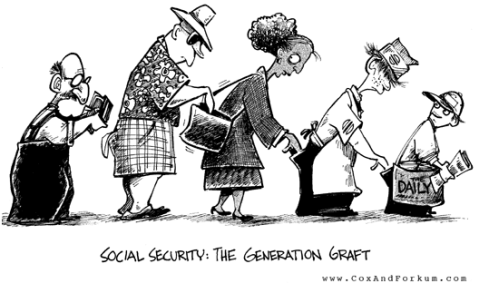

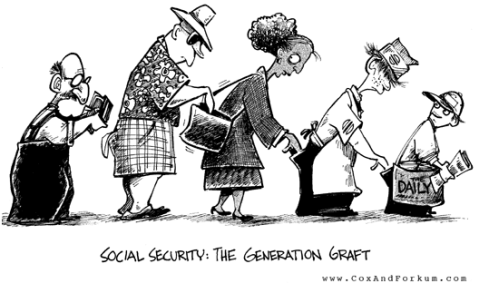

Why is it such a bad thing? Because all Ponzi schemes eventually collapse. Social Security will, too, and probably before the readers of this blog retire.

(OK, there is a lot of debate over when/if Social Security will dry up, but I'll contend that if your retirement plans depend upon collecting Social Security checks, that is a risky plan at best). We all know the story. The magical age at which one qualifies for Social Security is not rising fast enough to keep up with the rising cost of living and average life span. But here's something you may not have known that is pretty frightening: The money that funds Social Security is not sitting in a trust somewhere, safely invested and earning modest interest. The money in the fund is invested in government treasuries. In other words, the the money in the Social Security trust fund has been lent to the government. No kidding. And the kicker? The debt the government owes to the Social Security trust fund is NOT counted in the national deficit. So tack on another

$2.4 trillion to the

current national deficit. Check out the episode "

In Search Of The Social Security Trust Funds" from the excellent Planet Money podcast series on NPR for more info.

All this leads me back to my original complaint: Americans are spending the money they should be saving. If you agree that this is a problem, how is that fixed? Previously in this post

I linked to an article co-authored by Peter Tufano, who was also partly responsible for the "$2,000 in 30 days" survey. Tufano suggests that perhaps people should be educated about compound interest and credit card debt, rather than educated about retirement savings. Seems like a good idea to me. I'm all for education on both topics. There is also the option of legislation to "protect consumers against predatory lenders". My knee-jerk reaction is usually to not involve the government and/or that people should be wary enough to know what they're getting into, but I think I'm in favor of this idea, too.

So what say all of you? Do you agree/disagree with what I've said? Like to argue points or add more? Have ideas for a fix or just need to vent a little like I did? I am eager to hear thoughts on this.

Happy New Year.

If you have ever had a period in your life where you dug Led Zeppelin, catching this show at some point is a must. This isn't just another tribute act. This band puts everything into the show, playing for over 3 hours straight each night. They do their best to recreate a real Zeppelin show, too: double-necked Gibson guitars, an acoustic set in the middle of the show at the front of the stage, the violin bow during Dazed and Confused, the rest of the band leaves the stage while the drummer does his best Bonham during "Moby Dick", and Jimmy even plays a theremin solo during Whole Lotta Love (who the heck has a theremin just laying around?).

If you have ever had a period in your life where you dug Led Zeppelin, catching this show at some point is a must. This isn't just another tribute act. This band puts everything into the show, playing for over 3 hours straight each night. They do their best to recreate a real Zeppelin show, too: double-necked Gibson guitars, an acoustic set in the middle of the show at the front of the stage, the violin bow during Dazed and Confused, the rest of the band leaves the stage while the drummer does his best Bonham during "Moby Dick", and Jimmy even plays a theremin solo during Whole Lotta Love (who the heck has a theremin just laying around?).

Tangerine

Tangerine If you have ever had a period in your life where you dug Led Zeppelin, catching this show at some point is a must. This isn't just another tribute act. This band puts everything into the show, playing for over 3 hours straight each night. They do their best to recreate a real Zeppelin show, too: double-necked Gibson guitars, an acoustic set in the middle of the show at the front of the stage, the violin bow during Dazed and Confused, the rest of the band leaves the stage while the drummer does his best Bonham during "Moby Dick", and Jimmy even plays a theremin solo during Whole Lotta Love (who the heck has a theremin just laying around?).

If you have ever had a period in your life where you dug Led Zeppelin, catching this show at some point is a must. This isn't just another tribute act. This band puts everything into the show, playing for over 3 hours straight each night. They do their best to recreate a real Zeppelin show, too: double-necked Gibson guitars, an acoustic set in the middle of the show at the front of the stage, the violin bow during Dazed and Confused, the rest of the band leaves the stage while the drummer does his best Bonham during "Moby Dick", and Jimmy even plays a theremin solo during Whole Lotta Love (who the heck has a theremin just laying around?).

Tangerine

Tangerine