As we approach a new year, I thought it might be worthwhile to post some thoughts that have been churning around in my head regarding the state of our nation. I'm afraid this post is going to pose a number of questions and not a lot of answers. But nonetheless I wanted to at least put these thoughts out here to see what others think.

I've been thinking of this post for a while, but was prompted to actually do it today after listening to the NY Times Front Page podcast, and hearing that "retail spending rose 5.5 percent in the 50 days before Christmas." This seemed to fit with what I saw in the past couple months - malls and retail outlets were packed with shoppers. But the story doesn't add up to me. Isn't the unemployment rate still almost 10 percent? How is it that people can afford to spend as much as they did in the same period of 2005?

I've been thinking of this post for a while, but was prompted to actually do it today after listening to the NY Times Front Page podcast, and hearing that "retail spending rose 5.5 percent in the 50 days before Christmas." This seemed to fit with what I saw in the past couple months - malls and retail outlets were packed with shoppers. But the story doesn't add up to me. Isn't the unemployment rate still almost 10 percent? How is it that people can afford to spend as much as they did in the same period of 2005?The Times article quotes Craig R. Johnson, president of the consulting firm Customer Growth Partners saying "In the face of 10 percent unemployment and persistent housing woes, the American consumer has single-handedly picked himself off the mat, brushed his troubles off and strapped the U.S. economy on his back." Let's see, unemployment still high, housing prices still low... maybe if we spend more that will fix it? The economy is slow, let's extend a lot of credit to people who don't really understand (or don't want to understand) the risk of credit card debt? It worked in 2005, maybe it will work again? Am I the only one who finds it strange that this man is applauding the American Consumer for what I can only see as the same pattern of reckless lifestyle that helped get us into this mess?

So that got me to wondering exactly how much money Americans are saving. A couple months ago I listened to the episode "Is America Ready for a 'No-Lose Lottery'?" on Freakonomics Radio. The episode presents an idea worthy of its own discussion - can a lottery be used to encourage people to save? But the story used to setup the episode was what stuck with me. In a survey last year, 2100 Americans were asked if they could come up with $2,000 cash in thirty days. 46% of Americans said they could not. The survey consisted of people from all income brackets, and the result I found most alarming was that of people making between $100,000 and $150,000 a year, 25% responded that they could not come up with $2,000 in thirty days. Now, the sample size is a bit small. So I won't dwell on this too long. But still.

OK, so back to how much Americans are saving. According to the Bureau of Economic Analysts, as of November 2010, Americans are saving about 5.3% of their disposable income. If you look back through the years in that link, you'll see that this is about as good as it has been for the past decade, about the same as the 90's, worse than the 80's, much worse than the 70's and worse than the 60's.

OK, so back to how much Americans are saving. According to the Bureau of Economic Analysts, as of November 2010, Americans are saving about 5.3% of their disposable income. If you look back through the years in that link, you'll see that this is about as good as it has been for the past decade, about the same as the 90's, worse than the 80's, much worse than the 70's and worse than the 60's.So Americans are saving a smaller portion of their disposable income than they saved in the past.

Is that a bad thing? Taken at face value, one would say yes. But there are other factors to consider. Perhaps Americans don't need to save as much because they're getting more for their dollar. Compared to the rise in inflation, healthcare and education costs are increasing much more rapidly. So, I'd say no, we're not getting more for our money, and yes, the decrease in percentage of disposable income saved is a bad thing.

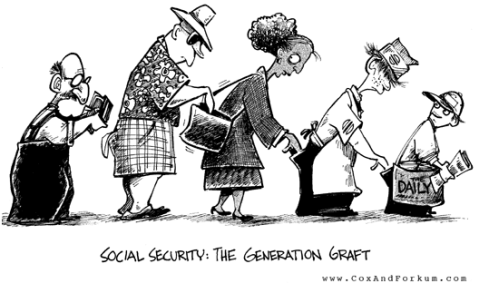

Why is it such a bad thing? Because all Ponzi schemes eventually collapse. Social Security will, too, and probably before the readers of this blog retire. (OK, there is a lot of debate over when/if Social Security will dry up, but I'll contend that if your retirement plans depend upon collecting Social Security checks, that is a risky plan at best). We all know the story. The magical age at which one qualifies for Social Security is not rising fast enough to keep up with the rising cost of living and average life span. But here's something you may not have known that is pretty frightening: The money that funds Social Security is not sitting in a trust somewhere, safely invested and earning modest interest. The money in the fund is invested in government treasuries. In other words, the the money in the Social Security trust fund has been lent to the government. No kidding. And the kicker? The debt the government owes to the Social Security trust fund is NOT counted in the national deficit. So tack on another $2.4 trillion to the current national deficit. Check out the episode "In Search Of The Social Security Trust Funds" from the excellent Planet Money podcast series on NPR for more info.

Why is it such a bad thing? Because all Ponzi schemes eventually collapse. Social Security will, too, and probably before the readers of this blog retire. (OK, there is a lot of debate over when/if Social Security will dry up, but I'll contend that if your retirement plans depend upon collecting Social Security checks, that is a risky plan at best). We all know the story. The magical age at which one qualifies for Social Security is not rising fast enough to keep up with the rising cost of living and average life span. But here's something you may not have known that is pretty frightening: The money that funds Social Security is not sitting in a trust somewhere, safely invested and earning modest interest. The money in the fund is invested in government treasuries. In other words, the the money in the Social Security trust fund has been lent to the government. No kidding. And the kicker? The debt the government owes to the Social Security trust fund is NOT counted in the national deficit. So tack on another $2.4 trillion to the current national deficit. Check out the episode "In Search Of The Social Security Trust Funds" from the excellent Planet Money podcast series on NPR for more info.All this leads me back to my original complaint: Americans are spending the money they should be saving. If you agree that this is a problem, how is that fixed? Previously in this post I linked to an article co-authored by Peter Tufano, who was also partly responsible for the "$2,000 in 30 days" survey. Tufano suggests that perhaps people should be educated about compound interest and credit card debt, rather than educated about retirement savings. Seems like a good idea to me. I'm all for education on both topics. There is also the option of legislation to "protect consumers against predatory lenders". My knee-jerk reaction is usually to not involve the government and/or that people should be wary enough to know what they're getting into, but I think I'm in favor of this idea, too.

So what say all of you? Do you agree/disagree with what I've said? Like to argue points or add more? Have ideas for a fix or just need to vent a little like I did? I am eager to hear thoughts on this.

Happy New Year.

8 comments:

Rollers, great post with a lot of complicated (yet supposedly simple?) ideas.

A couple of random thoughts, since I doubt we can sum this thing up concisely:

Inflation is pretty high, in fact it's a lot higher than interest you can earn in a bank. That signal means spending today will save you more money than saving today and spending later.

This relates to another clear signal the recent fiasco has taught us: Saving money doesn't pay. Those of us who saved money, invested even wisely, may have lost up to 50% of our nest egg in what felt like over night. For baby boomers, many of whom have just started entering retirement, this has been devastating. Same can be true for many who view home equity as a form of savings or investing.

Our political leaders have been doing bad economic things to our economy at the expense of our people, gutting our economy and assets for liquid money and imported goods. I agree with your lament, we should be saving more, but I disagree that it is an education problem, since people are behaving honestly based on the economic signals that are being sent.

The Gov cooks a lot of stats (as it cooks our currency) to avoid outrage. Unemployment is ~10% as currently calculated, but they changed the calculation to exlude those "discouraged workers" who have been out of work longer than 6 months. Add them in, and it's closer to 17%. Add in long term discouraged workers, and it's ~23%.

Politicians keep the dollar "strong" which encourages a trade deficit and investment deficit all in the name of purchasing power. A great policy would be to weaken the dollar.

Another great policy would be to put honesty back in the statistics like inflation and unemployment. This would include honestly auditing the fed and restoring some more prudent control over the currency.

So with bank accounts paying next to nothing, prices in the process of rising and real estate as uncertain as vegas, I would love to hear a lesson on compound interest.

P.S. Your point about SS is dead on, and speaks to a larger "teachable moment." If our own government is unable to act fiscally responsible (what is the savings rate of the Federal Gov't?), then what kind of example does that provide?

Layers and layers of historical bailouts by the government sends a devastating message to people.

P.P.S. Rollz, again, great post, great use of pics (special shout out to the MOA), figures, stats and supporting links.

Rye, thanks for the comments, and a special thanks for dividing one comment into 3. When people see more comments they realize that the comment recession may be over and that it's OK to come out and comment a little. It's good for the blogonomy. Come on, everyone!

Regarding saving, inflation, etc... good point about spending now vs. interest in a savings or money market account in order to spend later. Assuming inflation doesn't get worse, I can't debate your point. Hopefully we're not discussing QE8 in two years.

I think I was coming at this more from a concern with the type of spending that was happening, though, as illustrated by the Times article. In my opinion, just because interest rates in a savings account are poor right now, it doesn't mean that one's money is better spent splurging at the mall.

And yes, people's retirement savings took a big hit ~2 years ago, but the market has recovered pretty well. People haven't made back money in their homes, but their other investments have probably made back a good chunk of what was lost.

I keep trying to qualify some of my thoughts here, but my brain is too tired and not producing much in the ways of coherent thoughts... I agree with your sentiments about the government and our economy, and I wasn't aware of shaping of unemployment stats - thanks for that. Five lobbyists from the financial industry for each member of congress, an unelected Fed that can cause massive swings in the economy (as you've complained about for years)...

I'm not suggesting that everyone has the ability to save, and I'm not suggesting that there aren't inherent risks, but we have to be smarter about how we spend our money and how we borrow our money.

Rollo, when I doubt the quality of my comments, I try to ensure quantity.

I don't want to overly focus on the recent collapse or current interest rates either, good point.

But for a long time, our government and institutions have been unlearning us the prudent lessons we used to take for granted. People used buy houses when they saved up the cash. Then it became 20% down when banks were pressured because owning a home was part of the American dream. Then it became 10% down, then no money down. Then, they didn't even bother to verify your income. Do we expect people to not trust what banks are telling them?

These habits have become generational, and it's difficult for even this kind of economic downfall to pop people out of the deep grooves that have been worn into their economic decision making process.

You're a family with an ongoing credit card balance who couldn't scrape the $2k together. Then things get *worse*. Will you be able to change all of the sudden? You can't sell your house to downsize. You can't get to your savings because it's regulated and penalized by the government (IRA, 401k, etc.). You can't pay off your credit cards all of the sudden because the 2 family earner status was down-shifted as Dad lost his full time job at the plant and has had to pick up lower paying part time work in the service sector.

It sucks for a lot of people now, and I'm a little critical of some of the experts' vague notions that if they would just reeducate people...

That being said, and as you noted, Americans tend to have a "low" savings rate. However, this is relative to what? What should it be? A rule of thumb I have heard is 10%. But why is that the right rate? I've heard others say that inflation is going to be so bad that we should be saving 20%. I've heard the Chinese save 60%.

All that said, again, I go back to the central government, which has had centered every single fiscal and monetary policy around turning people into consumers and debtors. Our economy is 70% consumption, and at least since Reagan, the gov has advocated "growing" the economy to get out of debt rather than actually paying off the debt through austerity. So it's hard for me to imagine anything being done on an institutional level until that changes.

Otherwise, pick a percent and hide it under your mattress. If it all collapses, we can get together and smoke it.

Very good points all around there. Well said, amigo.

I can only add a tiny bit to that: Regarding the savings rate compared to other nations, I've heard it argued that it's not fair or easy to make that comparison, because you have to take into account the services/benefits that another nation does/doesn't provide its citizens via taxes etc.

great discussion - and indeed, the large number of comments duped me a bit :)

I teach high school students about compound interest - most of them get it, but it certainly makes no impact on teenage consumerism. I have had also students ask me about why inflation was above savings rates. I'm not an expert at monitary policy but I've always read that the fed has current interest rates so low is so that people do make the decision to spend, rather than save their money?

These days a penny saved is 0.97 penny earned (inflation - savings?)

So does anyone say that the fed's policy of setting interst rates low is working?

I agree that it's likely more than just fed policy that sent people out shopping - we are a consumer society, so we're compelled to go out and spend our way out of financial problems. That's one of the reasons increasing/extending unemployment and SNAP benefits is one of the most effective ways to directly stimulate the economy.

But those programs also don't encourage/allow for much savings. SS is good example, I think it's crucial to a ton of people - but the fact that the future of the government's own savings program is unclear sends a very clear message: savers are suckers.

Rolls, here's another link, this one about housing.

Post a Comment